FHA Manual Underwriting & VA Loan Manual Underwriting Guidelines

Underwriting Reminders for Loan Prospector® Caution Risk Class Mortgages This document provides helpful reminders for underwriting credit and capacity for mortgages receiving a Caution risk class from Loan Prospector. As always, individuals responsible for making the final lending decision should ensure that all requirements in the Single.

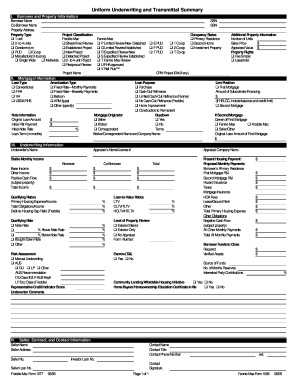

FHA and VA loans can be underwritten manually when the Automated Underwriting System (AUS) finding are not approve/eligible. The Automated Underwriting System (AUS) is a program that analyzes credit reputation, capacity, and collateral. Some lenders will not allow FHA manual underwriting and VA loan manual underwriting.What is Fannie Mae’s Desktop Underwriter?

Fannie Mae’s Desktop Underwriter (DU) or Desktop Originator (DO) determine whether a loan meets Fannie Mae’s eligibility requirements by providing lenders a credit risk assessment. This program is run by mortgage Loan Originators and underwriters in order to determine the risk of the loan.The Automated Underwriting System (AUS) findings are labeled: approve/eligible, approve/ineligible, refer/eligible, refer/ineligible, and refer with caution. Manually underwritten mortgages require refer/eligible findings and often approve/eligible can be downgraded to a manual underwrite.

What is Freddie Mac’s Loan Prospector?

Freddie Mac’s Loan Prospector (LP) is a tool that determines risk assessment with borrower’s criteria for their eligibility requirements. This program is run by mortgage Loan Originators and underwriters in order to determine the risk of the loan.Every borrower’s situation is different and unique, but both VA and FHA loans can be manually underwritten when they meet specific requirements. Loan Originators run this program during the pre-approval process.VA Loan Manual Underwriting Key Factors

- The max debt-to-income is 41% with no compensating factors.

- Can go higher on debt-to-income with compensating factors for a manually underwritten loan.

- For manually underwritten mortgages, a borrower should have re-established credit when past credit is adverse.

- Should have three trade lines with 12 months ratings and include manually rated trade lines (utilities, cell phone, and others) when necessary.

- Timely payments in the past 12 months.

- Verification of rent or canceled checks for the most recent 12 month period for the most current housing obligation.

- Past due collections and charge offs can indicate a disregard for credit obligations.

- A letter of explanation is required and will be considered in the underwriting analysis.

- All collections and charges offs with a repayment plan will be included in the debt to income ratio.

- Payment shock will be a factor with a manually underwritten loan.

- Eligible for 100% financing.

FHA Manual Underwriting Key Factors

- Verification of rent or canceled checks for the most recent 12 month period for the most current housing obligation.

- Should have three trade lines with 12 months ratings and include manually rated trade lines (utilities, cell phone, and others) when necessary for a manually underwritten loan.

- The max debt to income is 43% with no compensating factors, but can go higher with compensating factors.

- Manually underwritten mortgages require timely payments in the past 12 months and cannot have more than two 30 day late mortgage or installment payments in the previous 24 months.

- Payment shock is a factor for a manually underwritten loan.

- If the borrower’s credit score is 580+ FICO:

- Eligible for maximum FHA financing of 3.5% down payment.

- If the borrower’s credit score is under 580:

- Limited to maximum loan-to-value of 90%.

- Reserve requirements:

- For one to two unit properties, one month mortgage payment (principal, interest, taxes and insurance) are required to be verified and documented.

- For three to four-unit properties, three months of mortgage payment (principal, interest, taxes and insurance) are required to be documented and verified.

Foreclosure and Bankruptcy for VA Loans

- Foreclosure, deed in lieu of foreclosure, and short sale must be dated greater than 2 years of trustee’s deed.

- Chapter 7 bankruptcy discharged for 2 years.

- Chapter 13 bankruptcy requires 12 month satisfactory pay history and court permission.

- No waiting period after chapter 13 bankruptcy discharge date.

Bankruptcy and Foreclosure for FHA Loans

- There is no waiting period after a chapter 13 bankruptcy discharge, but requires manual underwriting.

- Manual underwriting allowed during a chapter 13 bankruptcy when:

- 12 month satisfactory payments have been made to the trustee.

- Trustees approval.

- Manual underwriting allowed during a chapter 13 bankruptcy when:

- There is a two year waiting period after chapter 7 bankruptcy.

- Three year waiting period after a foreclosure.

Since late 2007 and the MORTGAGE MELTDOWN started we’ve had many “inquiries” from prospective MN & WI buyers who’ve wanted to get into a new home or BACKinto home ownership. The last couple years have been hard on many people even though the Federal Government says that the recession is behind us. People have had their incomes cut back, lost jobs, bankruptcies, foreclosures and short sales.

What I wanted to share with you is a current (as of today) crib sheet of how long certain negative things need to be “seasoned” before different types of mortgage financing can be offered.

Freddie Mac Underwriting Guidelines Matrix

Let’s get a list of different situations or events may be required for waiting periods for different types of financing options:

Allregs Freddie Mac Underwriting Guidelines

Bankruptcy

The two most common types of bankruptcy (BK) are the Chapter 7 (liquidation) and the Chapter 13 (reorganization).

- FHA will need a Chapter 7 BK to be dismissed 24 months (or 1 year for someone who’s eligible for the Back to Work program). Someone who is IN a Chapter 13 and is in the process of REPAYING their debts can qualify for a FHA loan after 12 months of proof of repayment, no “lates” on anything on their credit report AND “permission from the court”.

- Conventional Financing with the Federal National Mortgage Association (FNMA/Fannie Mae) after a Chapter 7 is allowed after 48 months from the discharge/dismissal date. A two-year waiting period is allowed if certain “extenuating circumstances” can be documented. The time is extended to 60 months if there is more than one BK within the last 7 yrs.

- Conventional Financing with the Federal Home Loan Mortgage Corporation (FHLMC/Freddie Mac) will generally require a borrower to have waited 84 months unless either “extenuating circumstances” can be met ( then its 24 months) OR when “extenuating circumstances” can’t be met and then what Freddie calls “Financial mismanagement” is assumed and then the timeframe is reduced to 48 months and a list of requirements must be met including a 680 score and a perfect rental history.

- The US Department of Veterans Affairs will allow an eligible Veteran to qualify for a VA loan typically two years after discharge date of a Chapter 7 BK. There are guidelines that the VA spells out for a Veteran to qualify between 1 and 2 yrs after discharge date according to Chapter 4 of the VA Lender Handbook: if both of the following are met

- borrower and/or co-borrower have reestablished satisfactory credit, and

- the bankruptcy was caused by circumstances beyond your and/or your spouses control (such as unemployment, medical bills, etc.)

Another situation for a determining that an applicant is a satisfactory credit risk is in situations where the BK was caused by failure of a business of a self-employed applicant and:

- the applicant obtained a permanent position after the business failed,

- there is no derogatory credit information prior to self-employment,

- there is no derogatory credit information subsequent to the bankruptcy, and

- failure of the business was not due to the applicant’s misconduct.

For Chapter 13 BK’s the 2 situations outlined that may conclude a VA lender to extend credit are :

- Satisfactorily making at least 12 months of payments and “permission from the court”

- Finishing all payments satisfactorily

- The USDA (US Department of Agriculture) has a Rural Development program that generally will require a discharge date of 36 months.

Foreclosure

A foreclosure is the legal process by which a mortgagee (typically a bank) obtains a court ordered termination of the home-owners “equitable right of redemption”.

- FHA requires a 36 months seasoning (or 1 year for someone who’s eligible for the Back to Work program)

- Fannie Mae and/or Freddie Mac require 84 months from the completion of the Foreclosure for the Date of the credit pull for the new loan. The old “between 5 and 7 year rule” was changed effective October of 2010. Now there is a 3 yr “extenuating circumstance” rule (90% LTV for a primary residence) with Fannie Mae and its at only 2 yrs with Freddie Mac.

- VA follows their guidelines for a Chapter 7 BK with the request that the complete facts / circumstances of the Foreclosure be submitted AND if the Foreclosure was on a VA loan note that “full entitlement” will not be available for the new loan.

- USDA generally requires 36 months OR if after 12 months, reestablished credit and an underwriter “waiver”. This is completely up to the discretion of the u/w… do you have a good one?

Short Sale

A Short Sale is an option of a homeowner selling a home for less than the balance on their current mortgages and the mortgagee agrees to a reduced payoff. The bank’s decision to allow a Short Sale is typically in lieu of the foreclosure process which can result in heft fees for the bank. This process and agreement does not necessarily release the homeowner from the obligation to pay the remaining balance of the loan known as the DEFICIENCY.

- FHA requires 36 months in most situations. If CERTAIN GUIDELINES are met that follow Mortgagee Letter 09-52… the homeowner could qualify for an immediate purchase. Did you catch that… RIGHT AWAY. This is an important guideline change that is often misunderstood. Another complicated option is the FHA Back to Work program that allows for a purchase after 1 year even if there were late payments on the mortgage against the property previously sold short.

- Fannie Mae guidelines right now require a 48 month seasoning for FULL ELIGIBILITY. Their “extenuating circumstances” rule may allow someone to borrow in as little as 2 yrs.

- Freddie Mac is sticking to their 48 month seasoning… or 24 months if their “extenuating circumstances” guidelines can be proven/met.

- VA guidelines that we’ve seen have looked very similar to FHA’s above; 36 months OR if after 12 months and fitting the similar new guidelines of ML 09-52.

- USDA generally requires 36 months OR with the right underwriter’s “waiver” and approval.

Did you get all that? Its pretty crazy and you can see that things are different now and the job of a “mortgage guy” (and a Realtor) is to know more than just “what’s the rate and fees”? These guidelines are effective today and changed a few times in the past year.

We have to educate consumers who are current home-owners that are in tough situations (ask me about the “Upside Down Playbook”) along with shoppers who have fallen into Hardships. The toughest part of our jobs right now is telling people what they need to know and not just what they want to hear. The hope is that the knowledge from the paragraphs above will help you shine and win more referrals and future business.