Quicken 2019 for Mac imports data from Quicken for Windows 2010 or newer, Quicken for Mac 2015 or newer, Quicken for Mac 2007, Quicken Essentials for Mac, Banktivity. 30-day money back guarantee: If you’re not satisfied, return this product to Quicken within 30 days of purchase with your dated receipt for a full refund of the purchase price. Quicken Windows is a stale, old product built and patched and barely held together. It needs a total re-write from the ground up, but I’m guessing the Quicken programming staff is so tiny they can’t get anything productive done. (For reference, see Quicken Mac and the disaster there). I can’t recommend this product any more. I used Quicken 2007 for home and business (Windows version) for 10 years. Tried the upgrade to 2011 but went back to 2007 version as new features were just complications. Now we have switched to Mac computers and bought 2017 Quicken for Mac. Hugely disappointed, can’t even print a reconciliation statement along with the illogical interfaces.

Want to replace Quicken? We’ve got you covered.

As the granddaddy of personal finance software, Quicken was once the best money management tool on the market. Heck, it was practically the only tool on the market. Now? Not so much.

Though it was all the rage back in the day, little has been done over the last few years to improve Quicken. In fact, Intuit (famous for programs like Quickbooks and Turbo Tax) actually sold off their ownership rights to Quicken back in 2016. Since then, rumors have swirled that Quicken will actually shut down its program for good.

Luckily, Quicken is not your only choice for personal finance software. These days, there are a number of alternatives that can help you manage your money as well as Quicken ever did…and for less money. In fact, some of the best Quicken alternatives are actually free!

So, if you’re looking for a new program to manage your money, you’re in the right place. Check out our list of the top 10 Quicken alternatives below.

Table of Contents

- 16 Best Alternatives to Quicken

Our Top Picks

Personal Capital [Editor’s Choice] – Personal Capital is our Editor’s Choice for Quicken alternatives. This free software automatically tracks your savings, spending, investments, net worth, and more. It’s easy to use and the free price tag makes it an excellent replacement for Quicken. We’ve used it for years and think you’ll love it too! Read the review | Learn more

Tiller – If you’re looking for a budgeting tool that also runs some basic financial reports, Tiller is it. This program takes spreadsheet budgeting to the next level by helping you create a monthly budget and automatically tracking your results. When it comes to tax prep, Tiller can also run detailed reports on itemized deductions, your annual spend by category, and more. Start with one of their templates, customize it to meet your needs, or build your own. Get it free for the first month, then it’s only about $5 a month. Read the review | Learn more

16 Best Alternatives to Quicken

1. Personal Capital

Personal Capital is our favorite money management software of all time. We’ve used it personally for years, and we continue to be amazed by this powerful software.

What’s so great about Personal Capital? For starters, it’s free.

That’s pretty awesome considering they offer a comprehensive collection of money tools in one convenient place. Here, you can track your spending, net worth, and investments. You can also use it to check your investments for expensive fees and calculate whether you’re saving enough for retirement. These tools are all 100% free and at your disposal after a simple sign up process.

So, how does it work?

In short, Personal Capital synthesizes the data from all your accounts and delivers a complete financial picture that’s easy to understand.

Just link Personal Capital to your bank, credit, and investment accounts and let the program do the heavy lifting. It imports your transactions and calculates how your spending aligns with your budget.

Unlike some other alternatives to Quicken, Personal Capital is more than just budgets. And, since it is free, it makes a great compliment to some of the other programs as well.

Personal Capital also offers a powerful investment management tool. It tracks your asset allocation, monitors your investment performance, and analyzes your fees. It even takes your retirement goals into account and estimates your retirement income/expenditures based on your financial data. And, of course, Personal Capital also calculates the value of your assets relative to your debt (i.e. your net worth).

It might sound like a lot going on, but the app is incredibly user-friendly. A summary of your financial situation is available on the dashboard as soon as you open the app.

With all these money tools being offered for free, you might be wondering how Personal Capital actually makes money. Good question. They also offer fee-based wealth management services. Those are entirely optional, and you’re in no way obligated to subscribe. Tons of users enjoy the free suite of tools without using the wealth management services.

In my opinion, Personal Capital offers the best free money management software on the market. With a robust collection of money tools and a free price tag, this program blows many of the other alternatives to Quicken out of the water. Check out our complete Personal Capital review for more information!

2. Tiller

Tilleris a relative newcomer as a money management software program. This financial tracking tool is used in conjunction with Google Sheets (Gmail account required). So, if you’re into spreadsheets, Tiller might be just your thing.

Although it started out as solution for budgeting, Tiller has become more than just a budgeting program. Tiller can help you prepare for tax season by running detailed reports on your itemized deductions, annual spending by category, and more. For self-employed people and freelancers, they also offer a nifty tool that helps you determine your estimated quarterly taxes. They also provide a debt snowball worksheet and some simple net worth tracking.

To get started, simply link your bank accounts to the program. Then, Tiller will automatically download your financial transactions into Google Sheets on a daily basis.

From there, you’re free to take advantage of Tiller’s limitless customization options. They provide multiple budgeting templates you can use, but you can also create a brand new spreadsheet unique to your preferences.

Every day, Tiller emails you a summary of your financial activity so you always know exactly what’s happening with your money.

You can try Tiller free for 30 days to see if it meets your needs. After that, it’s about $5 a month, or free for a year if you’re a student.

3. YNAB

You Need a Budget (YNAB) is an excellent choice for anyone who wants an easy to use and effective budgeting app.

YNAB doesn’t offer a whole suite of money tools like Personal Capital. It focuses on two things: building a realistic budget and tracking your spending. And that’s ok, because it does them both very well.

I say a realistic budget because YNAB’s philosophy is that a budget is fluid and should be adjusted frequently in response to what’s going on in our lives. That’s why YNAB makes it so easy to move money between spending categories to keep your budget balanced.

For example, if you’ve budgeted $300 for groceries, but your transactions indicate that you’ve spent $340, YNAB will notify you that you’ve overspent and prompt you to deduct that $40 from another category. This system is especially useful if your goal is to maintain a zero-sum budget.

When you use YNAB, you have two choices. You can either automatically import your transactions by connecting to your bank and credit providers, or you can enter your transactions manually. Obviously, automating things is easier, but some may appreciate the option to do things the old-fashioned way.

YNAB offers a free 34-day trial, so you can try a full month of budgeting with no commitment. After that, the cost is $6.99 a month, billed annually. That means once a year, you’ll pay $83.88 to use the app/software. Unless you’re a student – then you can enjoy 12 months for free – which is a pretty cool benefit.

Also cool is that YNAB offers a 100% money-back guarantee. So, if you buy the app and decide it’s not helping you take control of your finances, YNAB will give you a full refund. Can’t argue with that!

4. Mint

Mint is a comprehensive financial tool that Quicken enthusiasts will probably appreciate. In fact, Intuit acquired Mint in 2010 shortly before they dropped Quicken from their suite of financial tools. Stew on that for a minute and think about which program Intuit thinks is better 🙂

Like with some of the other Quicken alternatives, when you link your financial accounts to Mint, you have access to your whole financial picture in one place.

As we mention in our full Mint review, you can build a budget, track your spending, monitor your investments, and manage your bills. The bills feature is really nice for people who haven’t automated their bill payments and want the ease of managing them on one platform.

Mint also lets you check your credit score and explains how it’s calculated. I think this is pretty neat because a lot of people don’t know their credit score or understand how these scores work.

With all that under one roof, you might be surprised to learn that Mint is free. Hey, we’ll take it.

5. PocketSmith

If you want to get a better handle on your money, PocketSmith might be for you. Like several of the best alternatives to Quicken, this program provides a strong option for budgeting. Where it really shines, however, is with its financial forecasting.

Instead of simply tracking what you’ve already spent, PocketSmith also helps you see what the future holds for your money. The “budget calendar” provides a daily look at your future income and expenses, all on an easy-to-read calendar so you can plan appropriately. Using your current info, you can even project your bank account balances as far out as 30 years into the future.

Our favorite feature is the “what if” scenarios. This feature allows you to test different spending and saving decisions and see how they affect your future financial growth. Wondering how reducing your grocery spending will affect your savings rate? Want to take a $2,000 vacation next summer? Use the “what if” feature to understand both the short-term and long-term consequences.

As with most Quicken alternatives, PocketSmith utilizes live bank feeds to update your transactions automatically. Over 10,000 different financial institutions are supported, so it’s pretty likely that you’ll be able to connect your accounts.

The basic functions of PocketSmith can be used for free, however you are limited to connecting just 2 accounts and 6-months of projections. The Premium version runs $9.95 per month and comes with 10 accounts and 10 years of projections. Unlimited accounts and 30 years of projections are available with the “Super” account which runs $19.95 per month.

6. CountAbout

CountAbout web-based personal finance software is another contender for the best Quicken alternatives. This program actually supports importing data from both Quicken and Mint, which is nice.

When you use CountAbout on a computer, there’s no app to install; you simply log in to their website. They do offer a mobile app for iOS and Android, but not all the features are available through the app.

Use CountAbout to create a customizable budget; then, sync it to your bank account to automatically import your transactions and track your spending. You can get a snapshot of your financial activity with widgets, or general full financial reports.

CountAbout offers two membership options: basic for $9.99 a year or premium for $39.99 a year. The only difference between the two is that the basic membership does not support syncing with online bank accounts. That means if you opt for the basic membership, your transactions will not be automatically downloaded. Your options are to enter transactions manually or import QIF files from your bank if they make those available.

If you’d like to try CountAbout before committing, you can get their 15-day free premium trial.

7. Moneydance

Moneydance is another viable personal finance software alternative to Quicken. In fact, if you currently have Quicken data, you can import it into Moneydance. It’s available as a desktop app for all the major operating systems and as a mobile app.

Moneydance’s interface kind of resembles a check register, where you see a record of all your transactions. Those transactions can be imported automatically by syncing with your online banking, or you can enter them manually. If you choose the automated route, you can also manage bill payments through Moneydance.

Of course, it wouldn’t be personal finance software without the ability to create a budget. Moneydance lets you create spending categories and track your expenditures. If you’re a visual person, you’ll appreciate the interactive graphing tool. You can also use Moneydance to track your investments and monitor stock performance.

If you’re technologically inclined (i.e. a tech nerd), you can actually develop extensions for Moneydance using an Extension Developer Kit they offer as a free download. But I won’t get into that today!

You can try Moneydance using their free trial, which works a bit differently than the other trials we’ve talked about. There’s no time limit on their trial, but you’re limited to 100 manually entered transactions. Still, that’s enough to decide if Moneydance is for you. After that, you can buy the full program for a one-time fee of $49.99. They also offer a 90-day money back guarantee when you purchase from their website.

8. Banktivity

Banktivityis a personal money manager made for Mac users. The newest version, Banktivity 7, is designed specifically for MacOS Sierra. And – like Moneydance – when you turn to Banktivity as a Quicken replacement, you can import your data for a seamless transition.

With Banktivity, you’ll sync your bank accounts and use it to build budgets, track your spending, pay your bills, and monitor your investments.

They also offer some really cool reporting options. For example, you can generate reports based on category spending or spending at a given merchant. So, if you want to track how much you spend on eating out, you can easily generate a report showing all your spending in that category over a given time frame. Or, if you want to get even more specific, you can easily pull up how much you spent on McDonald’s in the past two weeks.

The “Find” feature in Banktivity is kind of like Mac’s spotlight – it lets you search all your transactions to find the one you’re looking for. This can be a great time saver when you’re trying to quickly check something specific.

Banktivity offers a free 30-day trial, no credit card required. After that, you can purchase the desktop app for a one-time fee of $69.99. You can then download the app on iPhone and iPad and sync across your devices.

9. GoodBudget

GoodBudget is a simple budgeting app that helps you plan and track your spending through a digital version of the envelope method.

If you’re unfamiliar with the envelope method, this is a style of budgeting where you use an envelope for each spending category. First, you’ll plan how much you’ll spend on each category (usually throughout the month). Then, you allocate cash for those expenses in each category’s designated envelope.

Throughout the month, you’ll take money from a designated envelope each time you need to spend in that category. If you run out of money in an envelope, you can’t spend any more on that category… unless you borrow the money from another envelope (which will reduce your spending power in that category).

The free version of GoodBudget gives you twenty envelopes and allows you to download transactions from one bank account. You can also sync across two devices – which is great for using it on desktop and mobile. You can also use one sync to share a budget with your partner.

GoodBudget Plus costs $6 a month or $50 a year. This gives you access to unlimited envelopes and bank account syncing. You can also use the app on five different devices.

Since you’re likely to have more than one account and may both want access on multiple devices, GoodBudget Plus is probably more practical for a couple who shares a budget. That being said, it’s great that this software also has a free option.

10. Dollarbird

Dollarbird is another simple, no-frills budgeting app that makes for a good alternative to Quicken. This app is unique in that it’s calendar-based rather than category-based. What this means is that Dollarbird focuses on tracking your income and spending by day, rather than by category.

So, when you open the app, you’ll see a calendar. From there, you have the option of adding transactions (income or spending) for each day. Although you do categorize your transactions, the app displays your net spending per day rather than a running category total.

At this time, Dollarbird does not support syncing with your online accounts. This means all your transactions must be entered manually. However, you can schedule recurring transactions so you’re not constantly required to enter your regular fixed expenses. If you’re paid a regular salary, you can do the same with your paychecks.

The free version of Dollarbird gives you access to one calendar – perfect if you’re doing a simple solo budget.

The paid Pro version allows up to 20 calendars and can be accessed by three people. Again, the paid option might be more practical for couples. You can opt to pay $3.99 monthly or $39.99 for the year.

11. Everydollar

Next on our list of Quicken alternatives, we have Everydollar. If you’re a Dave Ramsey fan, you may want to give his budgeting tool a try.

Everydollar lets you budget your income into customizable spending categories, then enter your transactions and track your spending. The free version doesn’t link to your online accounts, so you enter your transactions manually. (If you want to automatically sync to your online accounts, you’ll need the paid version.) That’s not a deal breaker, but one thing I’ve noticed is that the app doesn’t seem to remember the category associated with a payee that’s previously been entered. Adding that would be a nice touch.

This is a super simple budgeting app that should meet the needs of someone who wants to get started with planning a budget and tracking their spending. It’s free, so there’s no risk involved in trying it out for a few months to see what you think.

12. PocketGuard

If simple smartphone apps are more your thing, PocketGuard deserves your consideration.

PocketGuard helps you budget your money, track your spending, and lower your bills. Better yet, it is available for both iOS and Android devices.

To get started, simply connect your credit cards, bank accounts, investments, and loans to the app. Your info will sync to the app and update automatically as transactions happen.

Although it’s not as powerful as the best Quicken alternatives, it can certainly help you keep an eye on your finances. Like some of the other programs, this app helps you see the balance of your connected accounts all in one place. It can also help you track and categorize your spending, set monthly income and spending goals, and provide tips on where you can save even more. The “in my pocket” feature even shows the amount of money you’ve got available to spend after accounting for all of your bills and savings goals.

PocketGuard’s main features are free. It’s worth noting, however, that they also offer a paid version called PocketGuard Plus. The upgrade offers significantly more customization (including custom categories, cash transactions, etc.) and costs $3.99/month or $34.99 if you pay annually.

13. MoneyWiz

MoneyWiz is another alternative to Quicken that works with Apple, Android, and Windows devices.

With this app, you can easily sync all of your financial data into one place. It also boasts a live syncing feature which allows you to sync data between devices in real-time.

Using MoneyWiz for budgeting is also a breeze. The app allows you to create different budgeting categories which you can set up as a one time or recurring category. Balances can be rolled over from one period to the next, and the program will even monitor your accounts for transactions – automatically updating the relevant information as you go. You can also transfer money between categories, similar to the “envelope” method.

In addition to the automatic syncing functions on the premium version of the app, MoneyWiz also allows you to enter your transactions manually. It is also capable of creating multiple reports and graphs, including custom financial reports.

So, if you’re looking to replace Quicken, MoneyWiz may be worth a try. While there is a stripped down version that’s free, you can get all the functionality by purchasing the premium version for just $4.99 a month or $49.99 per year.

14. Status Money

Are you competitive about your finances? There’s an app for that.

Status is a free program that allows you to compare your financial situation with your peers. Simply connect your accounts and start comparing right away. Then, use those comparisons as motivation to improve your own financial situation!

Of course, Status is about more than just comparing yourself to others. With Status, you can track your net worth, create spending goals, and monitor your credit. The program also analyzes your saving and spending by category, offering suggestions to improve your situation along the way.

Although Status is not nearly as robust as many of the other options, it is free to use. (It is ad supported, so keep that in mind when considering their suggestions.) So, while it may not be the perfect Quicken replacement, it won’t cost anything for you to test it out.

15. Wally

Wally is another personal finance app available for use on your smartphone. This app focuses entirely on budgeting and tracking your expenses. So, if you’re somebody who needs help with those two things (and who doesn’t?), Wally may be for you!

Although the app is attractive, it isn’t very complex. Unlike almost every other program on this list, with Wally, you won’t connect your accounts. For those who are a little skittish about cloud-based apps, this may actually be seen as a plus.

Effectively, Wally is like using a paper budget…except it’s on your smartphone. You’ll have to manually enter your income and transactions, although you do have the ability to create recurring expenses for bills that stay the same every month.

Even though it lacks automation, Wally does a good job of doing what it sets out to do – help people manage their monthly budgets. Once you set it up, you’ll be able to quickly compare your monthly income to your expenses, helping you to get a firmer grasp on your finances.

Wally was originally available just for iPhones, but they recently unveiled a new version for Android. According to their website, the app is (and always will be) free. There are plans to add some paid features, but we’ll have to wait and see what those are when they are rolled out in the future.

16. GnuCash

GnuCash is a free open-source financial management software that runs on some Windows and Apple operating systems.

The app uses the double-entry accounting method to help you keep track of your finances. Business owners should already be familiar with this concept as it is the preferred method used for balancing books and keeping accurate financial records for companies.

With that said, the app can help with your personal finances as well. Through GnuCash, you can track your bank accounts, income, expenses, and investments. If you’re planning to replace Quicken, you can input your information directly from your old software. GnuCash is also capable of running a variety of financial reports for those who need them.

GnuCash is typically better for those who have a business and isn’t a perfect fit for most people’s personal finances. However, it is free, so it may be worth a try.

Quicken Alternatives: Final Thoughts

With Quicken no longer the only financial tracking game in town, there are plenty of options to choose from. Whether you’re looking for a simple budgeting program or a complete personal finance software package, there’s enough variety on this list to suit almost any need.

Although everybody has their preferences (us included), ultimately, the best financial tools are ones you’ll use consistently. So why wait? Use one of the links above to download a free app or start a free trial to find out what program works for you.

How many of these money management tools have you tried? Which is your favorite? Let us know in the comments!

Quicken was traditionally known as one of the best personal finance software options for desktop users. However, the Mac version had traditionally lacked the features found in the PC version, and that was disappointing to many users. While last year's version was a big improvement, it still wasn't there for everyone.

After using Quicken for Mac 2019 for several weeks, we're happy to see that Quicken has continued the improvements over prior years. It's not as robust as we'd like to see yet, but it's definitely been moving in the right direction.

So, how did Quicken for Mac 2019 do? Honestly, it's an incremental improvement over 2018. But we like the direction it's going, and if you can get a great deal on pricing (which you typically can on Amazon or when they have a sale), it could be worth it.

- Incremental improvements over 2018 version

- A great mobile app with seemless sync across platforms

- Price is still a concern, but if you can find a great deal, go for it

Product Name |

Price |

Platform |

Promotions |

Key Features Of Quicken For Mac 2019

Quicken For Mac continues to build on the many traditional features that Quicken users expect. As always, it comes with great spending tracking (compared to other online options like Mint and Personal Capital), it has investment tracking, and budgeting.

For 2019, they have improved the usability of the platform, but the navigation is still a little challenging. Even after using Quicken for about a week, I still find it hard to get to different reports. It's not intuitive.

They also improved the web interface for Quicken. If you don't want to use the desktop software, and prefer a web version (like what you get with Mint), you can have that now. But I prefer the app over the web version.

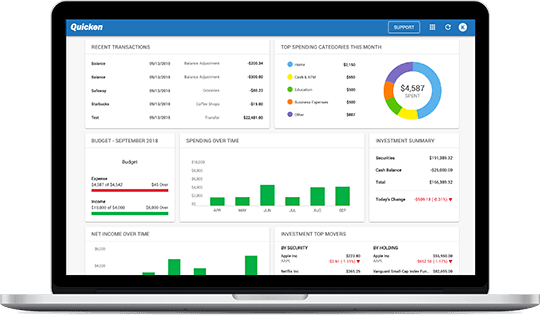

Here's what the home screen looks like:

Instead of being under reporting, most of the things you'll care about are actually available by clicking on the 'Acccount' sidebar - for example, your income and spending isn't viewable under 'Reports', but it's actually visible under 'Banking'.

Here's an example:

Here's another example. One silly thing that's missing is having income and expenses together on one page. I think there is a report you can run, but there's no easy to access dashboard that compares your income to your expenses (except in the mobile app, which is odd).

Quicken for Mac dramatically improved their investment tracking for 2018, but this is one area that didn't continue to improve into 2019.

There are still issues here. When I imported my accounts, some positions transferred the cost basis, while others didn't. Not a huge deal, but very odd. Also, it's still missing key reports that I valued in the Windows version - most notably the asset allocation and ability to play with your allocation in the program.

See the investment screen here:

Also, Quicken touts that you can now see investment performance, but it consistently showed 'N/A' for every account. My guess is that Quicken calculates this in the program, versus using historical data. That is a good thing in that you get a real snapshot of your performance, but a bad thing in that you need the Quicken app to consistently update to make it happen.

Here's what the screen looks like:

If you check the comments below, you can find other frustrating experiences with the investing tracking in Quicken for Mac. It has so much potential, but it's just not there yet.

Quicken 2019 Mobile App

The Quicken 2019 for Mac mobile app is probably my favorite feature that has been improved. This app has existed since the last few versions, but I found it glitchy years ago and gave up on it. For this review, I started using it again, and it's actually a bit more user friendly than the desktop version.

Here's the home screen of the mobile app:

As you can see, you get your account balances and recent transactions right at the top of the page. You can link this with Quicken's new credit card, and easily categorize your transactions on the go. It then seamlessly syncs with the desktop version.

One of the features I love on the mobile app, which is missing in the desktop version, is easily being able to see your income and expenses against each other.

Here's what that looks like:

I don't know why this can't just be included on the main page. There's also something funky up with the net income over time graph... maybe a glitch?

The pricing for Quicken For Mac 2019 continues to be a focus point for most users. Quicken changed their pricing model last year to a subscription-based model, instead of a one-time fee. I see this as both good and bad.

It's bad, because many Quicken users kept their software for years, and never upgraded. For users, this was fine - because you could avoid bad rollouts like Quicken for Mac 2017. However, to continue to receive updates and banking information, you had to update every few years anyway or Quicken would cut you off.

It's good, because my hope is with more recurring revenue, Quicken can continue to improve their software and ensure banking connectivity.

Quicken For Mac 2019 has three price points this year. I think 90% of users would benefit simply using the Deluxe version, which is $49.99/yr at full price.

Here's what the pricing looks like:

Quicken Essentials For Mac Manual

Deluxe | |

|---|---|

Best For: | Users with investments and loan tracking |

Price: | $49.99/yr |

It's hard to say if Premier is worth the huge additional price. I think Deluxe is the best value, for the added features of investment and loan tracking. But I've never used BillPay, and I highly recommend that most people don't use a service like BillPay because not only does Quicken charge more, but many banks charge for the service as well.

Note: For Windows, there is also a Home and Business version. However, we think most consumers with a small business would benefit more from using a tool like Quickbooks, versus using Quicken Home and Business.

Special Promotional Pricing

As you probably already know, Quicken is notorious for running promotional pricing all the time. Recently, they were offering 40% off their prices - which I think is a fair price for the product.

I would have a hard time paying $49.99 per year for Deluxe, but paying $29.99 per year makes much more sense - especially considering that I would typically upgrade every 2-3 years, this aligns much better with the pricing I'd expect.

However, in our search for deals, we found that Amazon.com is offering a 14-month subscription of the Deluxe version for $38.49 (which is 30% off full price). Given the $49.99 price is $4.17 per month, Amazon's deal is $2.75 per month. Still not as good as Quicken's own sale, but the second best deal we've found.

Check out the deal on Amazon here.

Quicken World Mastercard

Another interesting product/feature that Quicken launched this year is the Quicken World Mastercard. The Quicken credit card provides real-time transaction notifications in the Quicken mobile app, and offers integration with Quicken for Mac desktop.

This card also gives you a free year of Quicken Deluxe when you spend at least $500 in the first 90 days. If you already have a subscription, you'll get a 1 year extension.

The card offers 2x rewards points on all your qualified spending, and has no annual fees.

Given that this card is really about integration with Quicken, we're surprised that you don't get Quicken free every year as long as you spend at least $500 per year. Otherwise, all the rewards are on par or below the other top rewards credit cards out there.

Pros And Cons Of Quicken For Mac 2019

As you can see, there are some definite improvements in Quicken for Mac 2018 versus the prior year. However, it's still not perfect and it still has a lot less features than you'll find in the Windows version.

Pros:

- Great mobile app to compliment the desktop version

- Improved Loan Tracking

- Spending Tracking Categories and Reporting

Cons:

- Poor Navigation And Not Intuitive

- Still Lacking Some Key Investment Features Like Asset Allocation

- New Subscription Pricing Isn't Worth It At Full Price

Final Verdict

The final verdict is that we're giving Quicken for Mac 2019 four stars. As I've been using it more and more, I'm actually liking it more than many of the free online money management tools out there. This is especially true since the mobile app has become much more useful.

However, for those that want desktop software, AND if you can get it at a discounted price, Quicken for Mac is a much better piece of software than before.

Have you tried Quicken for Mac 2019? What are your thoughts?

Quicken For Mac 2019

- Product Cost - 60

- Ease Of Use - 83

- Tools And Features - 90

- Customer Serivce - 85

Quicken For Mac Download

Summary

Free Quicken Manuals

Quicken For Mac 2019 has continued to improve on what’s been working and has an even better mobile app experience.